Azure Reserved Instances: The Underrated Power Move in Cloud Cost Optimization

An analysis of Azure Reserved Instances versus Savings Plans, showing how mid-term restructuring enables deeper savings and greater financial flexibility.

The conventional wisdom is simple:

- Reserved Instances are rigid but save more.

- Savings Plans are flexible but save less.

That story is convenient. It is also incomplete.

In reality?

The flexibility story is backwards, and the savings gap is far wider than most FinOps teams realize.

We will break down why Azure RIs routinely outperform Savings Plans by 20–40%, how mid-term commitment restructuring turns them into a dynamic financial instrument, and how automated commitment management elevates those gains across thousands of machines.

Important clarification: This discussion does not affect production deployment decisions made by developers, including instance types or families. It focuses exclusively on optimizing financial commitments around existing implementations to achieve the deepest possible discounts.

The Myth: "Savings Plans Are Almost as Cheap and Much More Flexible"

This is the story Azure tells:

- Savings Plans: up to 65% off or 35% off OD pricing

- Reserved Instances: up to 72% off or 28% off OD pricing

So the difference must be… 7%, right?

Wrong, and massively misleading.

If you're paying 35% of list price under SP, and an RI drops you to 28%, that's a 20% reduction in actual spend: not 7%.

And the Savings Plan maximum stated "up to 65%" figure represents a headline ceiling, not the actual discount reflected in the published prices.

In practice, those published prices typically translate to discounts in the 32%–55% range compared to on-demand (OD) pricing.

This is technically consistent with the "up to" claim, but materially lower in real terms.

Real Examples Where RIs Win Big

Straight from the Azure price list (D-series family)

- US regions: 20% advantage

- EU regions: 33% advantage

These gaps aren't theoretical; they are sitting in plain sight on Azure's pricing pages.

The Surprise Twist: RIs Are Actually More Flexible

Savings Plans are marketed as the adaptive option.

But technically flexible ≠ financially flexible.

Savings Plans lock you into:

- A fixed term

- A fixed hourly dollar spend

- No ability to reduce, reshape, or escape without penalty

Meanwhile…

Mid-term restructuring enables organizations to:

- Change the term length

- Change the region

- Change the VM family

- Reallocate commitments across as many or as few instances as needed

As long as the remaining financial liability stays the same or increases, you can exchange and reshape the entire engagement.

This is the hidden superpower.

1. Reducing Monthly Spend Without Losing Discounts

Usage changes. Businesses change.

But SP forces you to keep the same commitment regardless.

RIs, however, adapt alongside you.

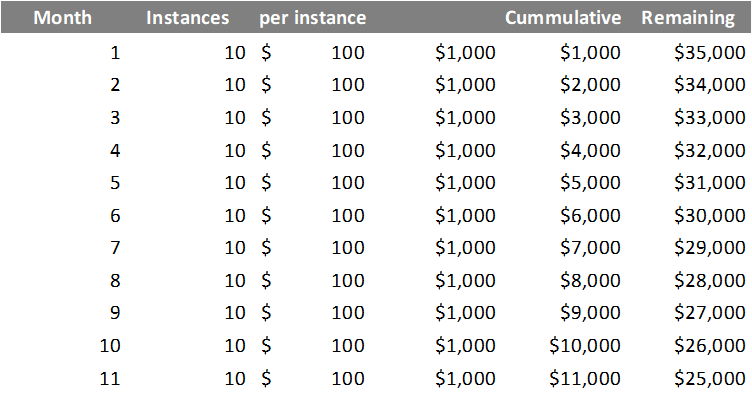

Scenario:

- 10 instances

- $100/month each ($100 is pricing with 3 years RI discount)

- 3-year RI → $1,000/month commitment

After 11 months, demand drops.

Remaining commitment: $25,000.

Roll it into a new 36-month RI and your new commitment becomes:

$25,000 / 36 = $694.44/month

Now you only need to commit to 7 instances instead of 10 — and you've preserved long-term pricing.

2. The Fold: Using 3-Year Pricing Without Being Locked In

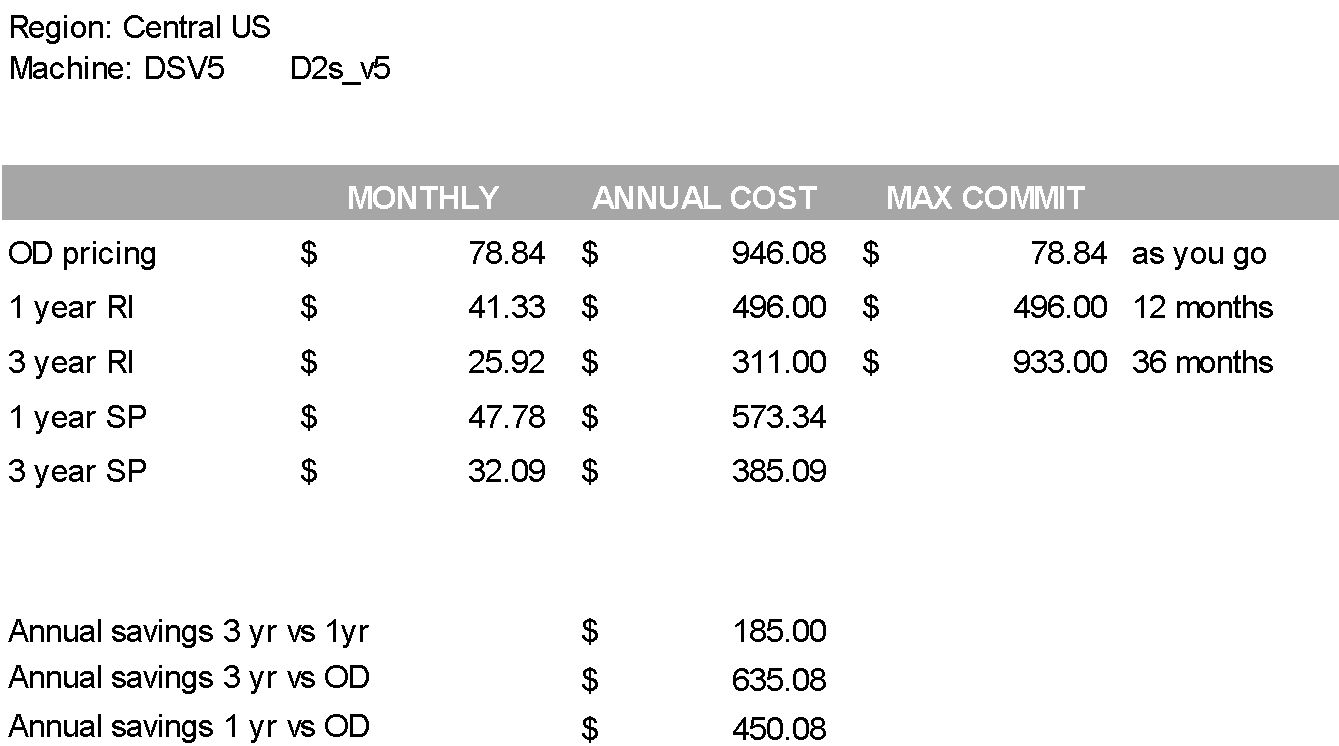

This is one of the smartest, least-known RI strategies. We're using real life pricing taken from the Azure price list to illustrate.

In this example:

- A 1-year RI costs $496/year

- A 3-year RI costs $933 total

Two years of a 1-year plan: $992 (2x496)

Three years under a 3-year plan: $933

A three-year commitment effectively delivers an extra year of usage at no additional cost.

However, not all organizations can take on a full three-year term. In those cases, the ability to roll remaining liability into a shorter timeframe provides critical flexibility.

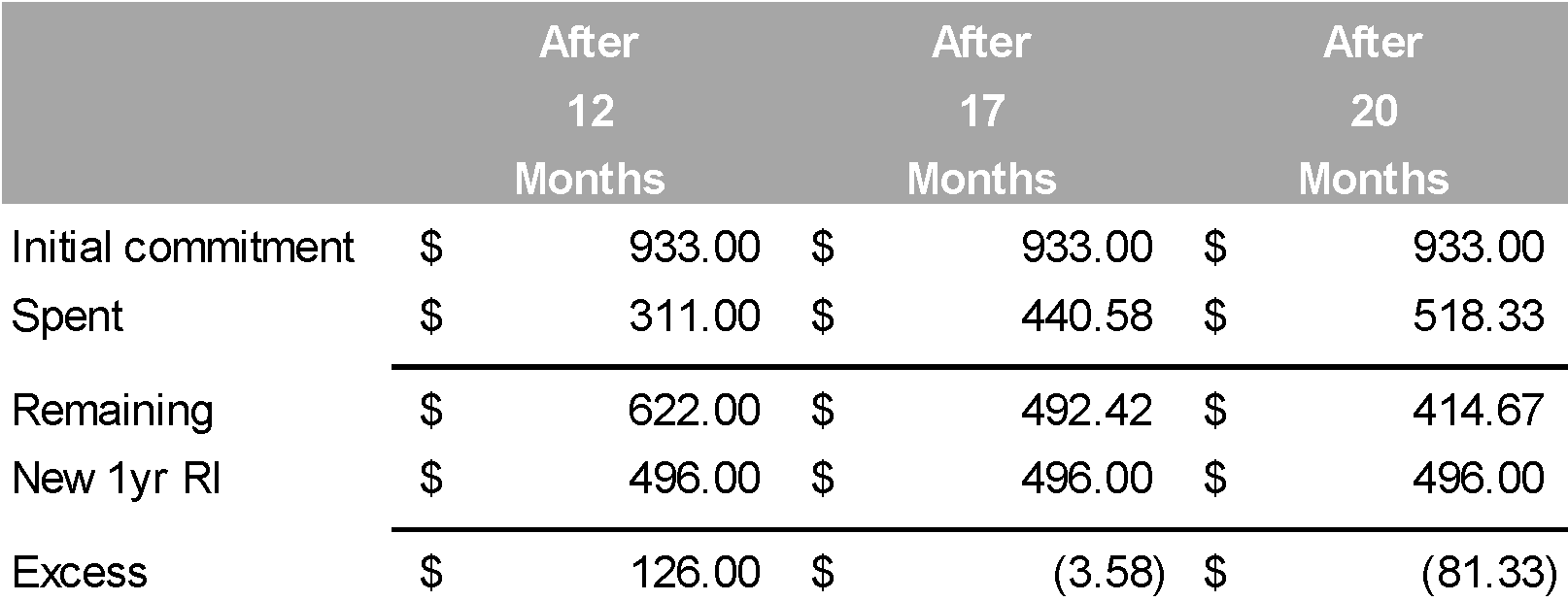

Because RIs are exchangeable, you can:

- Run the 3-year RI for 12 months

- Roll the remaining value into a new 1-year RI

- Repeat

That means you effectively run on 3-year pricing while keeping 1-year horizon flexibility.

For example, consider a 3-year RI contract running its course.

After 12 months, the remaining liability aligns closely with the cost of a new 12-month RI (approximately $496), allowing the organization to 'fold' the remaining value into a new 1-year term. This allows the financial commitment, not actual usage, to down-ramp in a controlled way while still benefiting from the reduced pricing of a 3-year RI.

3. Handling Seasonality: RIs Beat SPs Even When Usage Varies

Most environments have cycles: high-load months and low-load months.

Savings Plans force a constant spend across the full term.

RIs let you shape commitments around seasonal peaks.

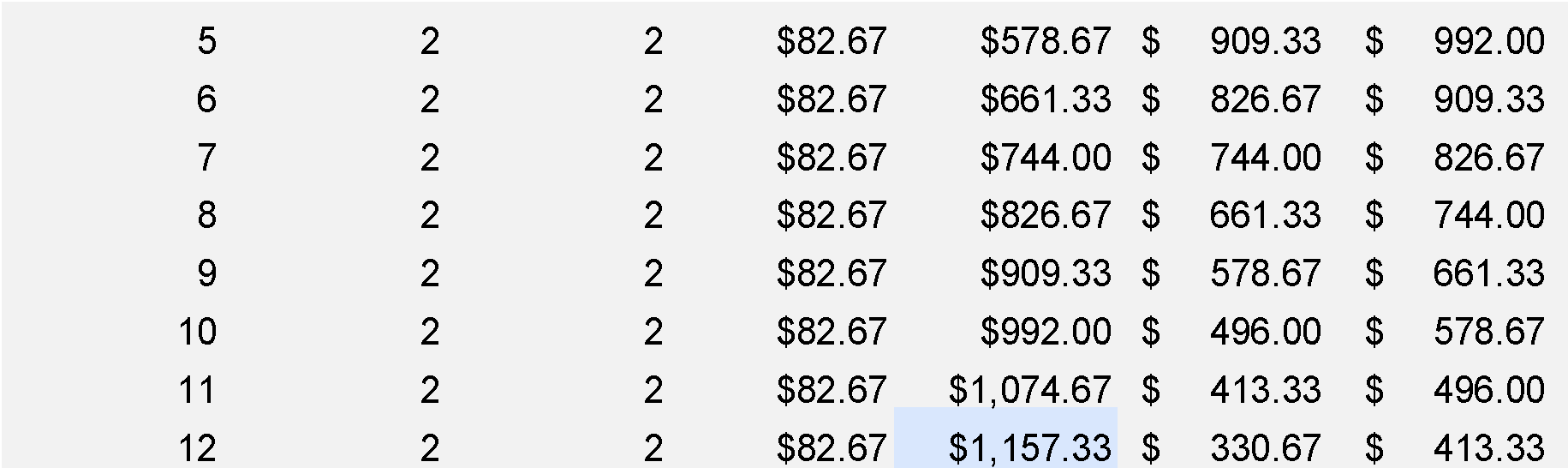

Scenario:

- Need +50% compute for 4 months

- Baseline for 8 months

- Same DSV5 instance from the previous example

SP approach:

- Commit to 2 instances (2x$47.78= $95.56/month)

- Burst the 3rd instance on-demand for 4 months (1x$78.84)

Total: $1,462.04

RI approach:

- Commit to 3 instances for 12 months ($124/month)

- After 4 months, restructure remaining commitment ($992) into a new 12-month RI for 2 instances at 2x$41.33 = $82.67/month

Total: $1,157.33

Result:

RIs cost 79.2% of the SP total ($1,157/$1,462) or almost 3 months of compute free through better financial alignment.

What is the trade-off? An additional four months of financial commitment.

However, as this cycle repeats in the following year, that residual commitment can be restructured again, either to support renewed peak demand or to roll into new workloads, preserving flexibility over time.

The Real Potential: Automation Multiplies RI Power

Managing RI restructuring manually at scale is impossible.

CloudHiro continuously:

- Tracks utilization and coverage

- Identifies restructuring opportunities

- Manages exchanges

- Prevents overcommitment

- Ensures maximum ROI on each committed dollar

RIs become a financial optimization engine — not a procurement checkbox.

Conclusion: RIs Aren't Rigid. They're a Strategic Advantage

When used correctly:

- RIs deliver deeper discounts

- RIs adapt better to changing demand

- RIs enable financial resizing mid-term

- RIs outperform SPs by 20–40% in real-world scenarios

Once you start structuring RIs dynamically rather than statically, the entire economics of Azure change permanently.

Tags

Ready to optimize your Azure costs?

CloudHiro can help you maximize your Reserved Instance savings and optimize your Azure spending.

Book a Demo